In today’s fast-paced world, where financial responsibilities and competing priorities seem to constantly demand our attention, the idea of consistently saving money can feel like a daunting task.

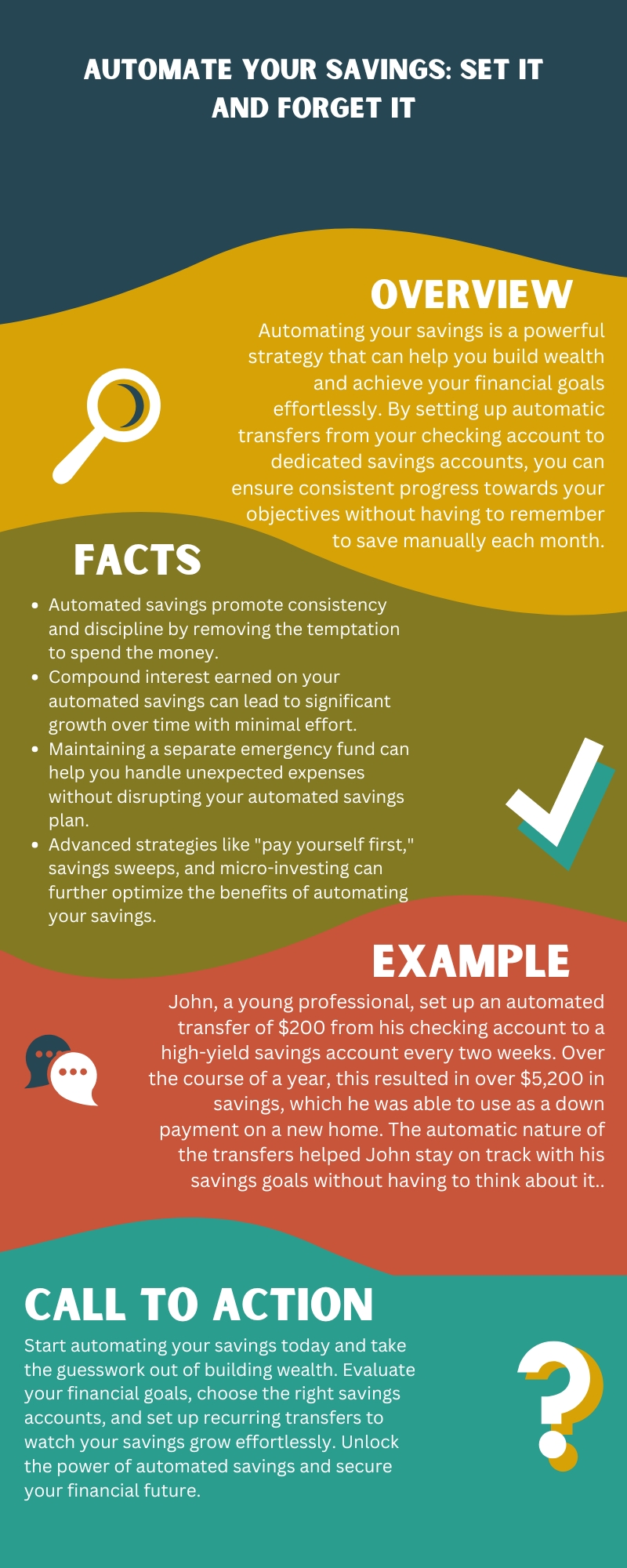

However, the benefits of building a strong financial foundation through regular savings cannot be overstated. Fortunately, there’s a simple solution that can help you take control of your financial future: automating your savings.

The Importance of Saving Regularly

Saving money regularly is crucial for achieving both short-term and long-term financial goals. Whether you’re working towards building an emergency fund, saving for a down payment on a house, or planning for a comfortable retirement, a consistent savings habit can make all the difference.

By setting aside a portion of your income each month, you can gradually accumulate the funds needed to weather unexpected financial storms, invest in your future, and enjoy greater financial security.

Automating Your Savings

While the importance of saving is widely understood, actually putting it into practice can be a challenge for many people. This is where automating your savings can be a game-changer.

By setting up automatic transfers from your checking account to dedicated savings accounts, you can effortlessly build your savings without having to remember to do it manually each month.

1. Consistency and Discipline

One of the primary benefits of automating your savings is that it promotes consistency and discipline. When you set up automatic transfers, the money is moved out of your checking account before you have a chance to spend it. This helps instill a savings habit and ensures that you’re consistently contributing to your financial goals.

2. Avoiding Temptation

Automated savings also help you avoid the temptation of dipping into your savings for non-essential expenses. By physically separating the money into a dedicated savings account, you’re less likely to be tempted to use those funds for unplanned purchases or impulse buys.

3. Effortless Growth

As your automated savings accumulate over time, the compound interest earned on those funds can lead to significant growth with minimal effort on your part. This “set it and forget it” approach allows your savings to steadily build, helping you achieve your financial objectives more efficiently.

Getting Started with Automated Savings

If you’re ready to start automating your savings, follow these steps to get the process up and running:

1. Evaluate Your Financial Goals

Before setting up any automated transfers, take the time to identify your short-term and long-term financial goals. This will help you determine how much you should be saving each month and where those funds should be directed.

2. Choose the Right Savings Accounts

Once you’ve identified your goals, research and select the appropriate savings accounts to help you achieve them. Consider factors like interest rates, fees, accessibility, and any special features that may be relevant to your needs.

3. Set Up Automatic Transfers

The next step is to set up automatic transfers from your checking account to your designated savings account. Most banks and financial institutions offer this feature, allowing you to schedule regular, recurring transfers on a schedule that works best for you, such as weekly, bi-weekly, or monthly.

4. Adjust and Optimize Over Time

As your financial situation and goals evolve, be sure to periodically review and adjust your automated savings plan. This may involve increasing or decreasing the transfer amounts, redirecting funds to different savings accounts, or exploring new savings strategies to help you stay on track.

Automated Savings Strategies

While the basic concept of automating your savings is straightforward, there are a few specialized strategies you can explore to make the most of your automated savings efforts:

Overcoming Common Challenges

While automating your savings can be a highly effective strategy, it’s not without its challenges. Here are some common obstacles you may face and how to overcome them:

1. Unexpected Expenses

Unforeseen expenses can sometimes disrupt your automated savings plan. To mitigate this, it’s important to maintain a dedicated emergency fund separate from your other savings goals.

This will help you avoid dipping into your long-term savings when unexpected costs arise.

2. Lifestyle Creep

As your income increases over time, it can be tempting to gradually increase your spending to match your new earnings.

This “lifestyle creep” can undermine your savings efforts. To combat this, regularly review your budget and automated savings plan, and make adjustments to ensure that your savings rate keeps pace with your income growth.

3. Maintaining Motivation

Sustaining motivation to save can be a challenge, especially when faced with competing financial priorities or the allure of immediate gratification.

To stay motivated, regularly review your progress, celebrate your milestones, and remind yourself of the long-term benefits of your savings efforts.

Conclusion

Automating your savings is a powerful tool that can help you build a strong financial foundation and achieve your long-term goals with minimal effort.

By setting up automatic transfers, you can take the guesswork and temptation out of the savings process, allowing your money to grow steadily over time.

Whether you’re saving for an emergency fund, a down payment on a home, or a comfortable retirement, automating your savings is a proven strategy for financial success.

FAQs

- How do I get started with automating my savings?

The first step is to evaluate your financial goals and choose the right savings accounts to help you achieve them. Then, set up automatic transfers from your checking account to your designated savings account. Start small and gradually increase the transfer amounts as your budget allows. Regularly review and adjust your automated savings plan to ensure it aligns with your evolving financial situation. - What are the key benefits of automating my savings?

Automating your savings offers several key benefits. It promotes consistency and discipline by removing the temptation to spend the money. It also helps you avoid dipping into your savings for non-essential expenses. Over time, the compound interest earned on your automated savings can lead to significant growth with minimal effort on your part. - How do I overcome unexpected expenses when I have automated savings?

To handle unexpected expenses without disrupting your automated savings plan, it’s important to maintain a dedicated emergency fund separate from your other savings goals. This will allow you to tap into those funds when necessary, rather than having to dip into your long-term savings. Review and adjust your emergency fund regularly to ensure it can cover your needs. - What are some advanced strategies for automating my savings?

Beyond the basic automatic transfer approach, there are several advanced strategies you can explore to maximize the benefits of automating your savings. These include the “pay yourself first” method, where you divert funds directly from your paycheck into savings; savings sweeps, which automatically transfer any remaining checking account balance at the end of each period; and micro-investing, which rounds up your purchases and invests the difference.