Imagine having an extra $1,000 in your bank account in just 90 days. That dream can be your reality with a focused and achievable plan. This challenge empowers you to take control of your finances and reach your savings goal faster than you might think.

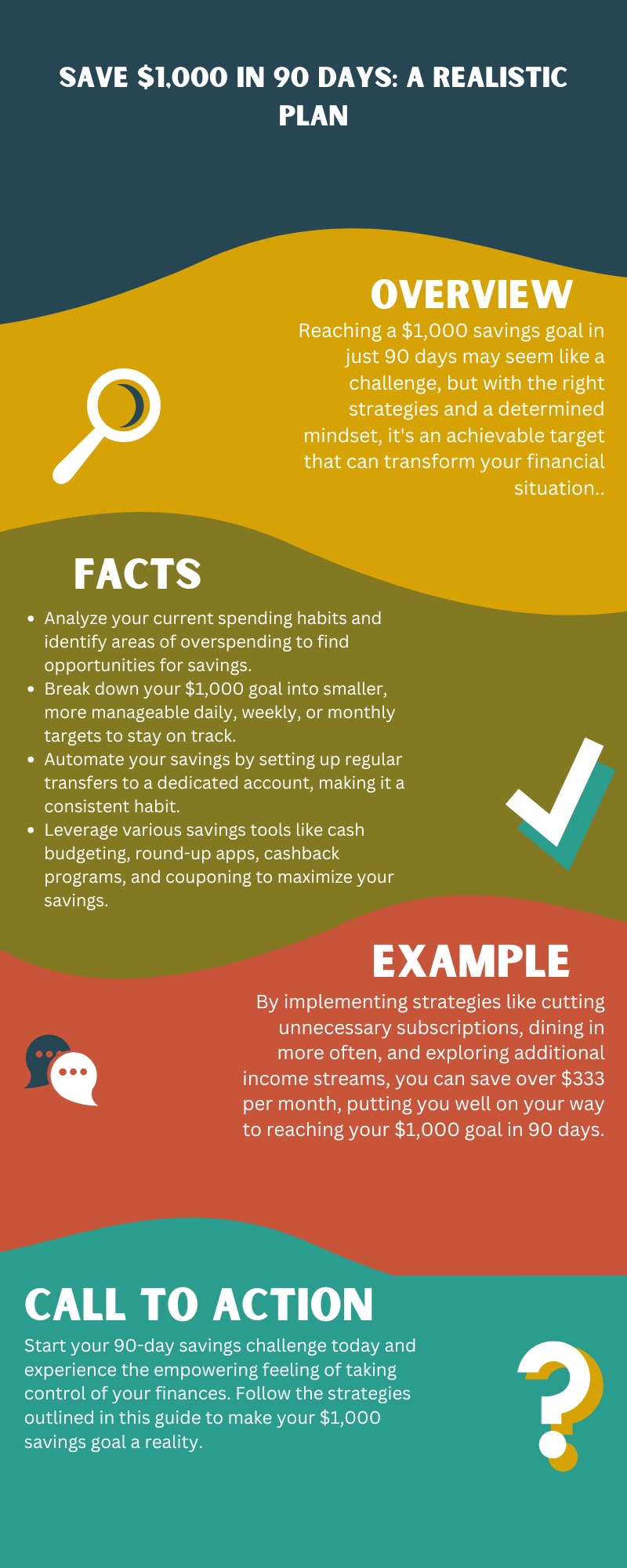

Saving $1,000 in 90 days may seem like a lofty goal, but with the right strategies and a determined mindset, it’s a realistic target that can transform your financial situation.

In this blog article, we’ll walk you through a step-by-step plan to help you save $1,000 in 90 days, covering everything from assessing your current spending habits to leveraging various savings tools and income-boosting opportunities.

Key Takeaways:

- Assess your current financial situation by tracking spending and identifying spending patterns to uncover opportunities for savings.

- Set a SMART savings goal of $1,000 in 90 days, and break it down into smaller, manageable targets to stay on track.

- Automate your savings by setting up regular transfers to a dedicated savings account, making it a consistent habit.

- Trim expenses by cutting unnecessary subscriptions, dining in more, shopping smartly, limiting impulse buys, and temporarily downgrading services.

- Boost your income through additional income streams, freelancing, or exploring direct sales opportunities.

- Leverage various savings tools like cash budgeting, round-up apps, cashback programs, and couponing to maximize your savings.

- Choose the right interest-bearing savings account to ensure your money grows at a competitive rate.

- Maintain motivation and a positive mindset by believing in yourself, celebrating milestones, and embracing imperfection.

Assessing Your Financial Landscape

Before embarking on your savings journey, it’s crucial to have a clear understanding of your current financial landscape. This involves tracking your spending and identifying any spending patterns that could be holding you back from reaching your savings goal.

1. Track Your Spending

The first step is to analyze your spending habits by reviewing your bank statements or utilizing a budgeting app. This will help you identify areas where you may be overspending, such as bank fees, frequent ATM withdrawals, or unnecessary subscriptions.

By understanding where your money is going, you can make informed decisions about where to cut back and redirect those funds toward your savings goal.

2. Identify Spending Patterns

Take a closer look at your spending patterns and ask yourself some critical questions. Are you consistently exceeding your budget on dining out? Have you forgotten about recurring subscriptions you no longer use? Identifying these spending patterns is the key to finding opportunities to cut back and save more.

Crafting Your Savings Strategy

With a clear understanding of your financial situation, it’s time to develop a strategic plan to save $1,000 in 90 days.

1. Set a SMART Goal

2. Automate Your Savings

3. Visualize Your Goal

Keep your motivation high by visualizing what you’ll achieve with the extra $1,000. Whether it’s a down payment on a dream vacation, a much-needed car repair, or building a robust emergency fund, having a clear picture of your goal in mind can provide the extra push you need to stay committed.

Trimming Expenses

One of the most effective ways to save $1,000 in 90 days is to identify and eliminate unnecessary expenses. Here are some strategies to help you trim your spending:

1. Cut Unnecessary Subscriptions

Review your recurring subscriptions for services you rarely use. Streaming services, gym memberships, or magazine subscriptions are common culprits that can drain your bank account without you even realizing it. Even canceling just two $15 monthly subscriptions saves you $360 per year.

2. Dine In More Often

Reducing your dining-out expenses is a significant step towards saving money. The average consumer spends a considerable portion of their income on food away from home. Challenge yourself to cook more meals at home, utilizing leftovers and planning your meals to avoid last-minute takeout temptations.

3. Shop Smart for Groceries

Adopt savvy shopping habits to stretch your grocery budget further. Utilize couponing apps, compare prices at different stores, and take advantage of loyalty programs to maximize savings. Consider buying non-perishable items in bulk and plan your meals around discounted ingredients to further reduce costs.

4. Limit Impulse Purchases

Avoid unnecessary spending by implementing the 24-48 hour rule for all non-essential purchases. This cooling-off period allows you to determine if the item is a genuine need or simply a fleeting desire. Resist the temptation to buy on impulse and redirect those funds towards your savings goal.

5. Downgrade Temporarily

Consider temporarily downgrading certain services to accelerate your savings progress. Switching to a more affordable phone plan or exploring alternative internet options can result in significant monthly savings. If you’re renting, research more affordable housing options in your area, though prioritize your quality of life during this temporary adjustment.

Boosting Your Income

While trimming expenses is crucial, you can also explore ways to boost your income to reach your $1,000 savings goal faster.

1. Explore Additional Income Streams

Supplement your primary income with creative ways to earn extra cash. Consider freelancing opportunities using your existing skills, explore gig work platforms like TaskRabbit, or sell unused items online or through consignment shops. Earning an extra $50 per week, for instance, adds up to $200 per month, putting you well on your way to reaching your $1,000 target.

2. Direct Sales

Direct sales can be an alternative income source, offering the flexibility to set your hours and build a business around your interests. However, it’s important to approach direct sales with caution. Research the company thoroughly, connect with a supportive sponsor, and avoid purchasing excessive inventory upfront.

Leveraging Savings Tools

In addition to cutting expenses and increasing your income, you can utilize a variety of savings tools to help you reach your $1,000 goal.

1. Cash Budget

Utilize a cash budget for discretionary spending to encourage mindful spending habits. Allocate a specific amount of cash for categories like entertainment or dining out each week. When the cash runs out, it signals a pause in spending until the next budgeting cycle.

2. Round-up Apps

Leverage the power of micro-savings with apps like Digit that automatically round up your purchases to the nearest dollar and transfer the difference into a separate savings account. These small, consistent contributions can accumulate surprisingly quickly.

3. Cashback Apps and Rewards Programs

Maximize your spending power by utilizing cashback apps and store loyalty programs. Earn rewards and discounts on purchases you’re already making, adding a little extra to your savings pot.

4. Couponing and Deal Websites

Utilize couponing websites and apps to find the best deals on everyday items and services. Combine coupons with store sales to maximize savings and redirect those funds toward your savings goal.

5. Yard Sales

Declutter your home and generate extra income by hosting a yard sale or participating in a community sale. Selling gently used clothing, electronics, or household items can give your savings a significant boost.

Selecting the Right Savings Account

To ensure your savings grow as quickly as possible, it’s important to choose the right savings account.

1. Interest-Bearing Accounts

Choose a high-yield savings account that offers a competitive annual percentage yield (APY) to make your money work harder for you. Explore money market accounts and certificates of deposit (CDs) as alternative savings vehicles, especially for longer-term goals.

2. APY and Fees

Pay close attention to the APY offered by different financial institutions and compare rates to ensure you’re earning the most on your savings. Be mindful of potential fees associated with certain accounts, such as monthly maintenance fees or withdrawal penalties.

Maintaining Motivation and Mindset

Reaching your $1,000 savings goal in 90 days will require a combination of strategies and a determined mindset. Here’s how to stay motivated throughout the challenge:

1. Believe in Yourself

Saving $1,000 in 90 days is a challenging but attainable goal. Maintain a positive mindset and trust in your ability to succeed. Every small step you take brings you closer to your target.

2. Celebrate Milestones

Acknowledge and celebrate your progress along the way to stay motivated. Whether you’ve reached a weekly savings target or successfully avoided an impulse purchase, recognize your achievements to reinforce positive financial habits.

3. Embrace Imperfection

Understand that slip-ups can happen during any financial journey. Don’t let minor setbacks derail your overall progress. View mistakes as learning opportunities and recommit to your goals with renewed determination.

Conclusion

Saving $1,000 in 90 days is an empowering challenge that requires dedication, planning, and a shift in mindset. By implementing the strategies outlined in this comprehensive guide, you can take control of your finances, achieve your savings goal, and lay the foundation for a more secure financial future.

Start your 90-day challenge today, and experience the transformative power of reaching your financial goals. Remember, every step you take towards saving $1,000 brings you closer to financial freedom and a brighter tomorrow.

Frequently Asked Questions (FAQs)

How Realistic is Saving $1,000 in 90 Days?

Saving $1,000 in 90 days is a challenging but achievable goal for many people. By implementing a strategic plan that includes cutting expenses, boosting your income, and utilizing various savings tools, you can make this goal a reality. The key is to break down the larger target into smaller, manageable steps and stay committed to your plan.

What are Some Effective Ways to Cut Expenses and Save Money?

Some of the most effective ways to cut expenses and save money include canceling unnecessary subscriptions, dining in more instead of eating out, shopping smartly with coupons and deals, limiting impulse purchases, and temporarily downgrading certain services like your phone plan or housing. By identifying and eliminating unnecessary spending, you can free up funds to put toward your $1,000 savings goal.

How Can I Boost My Income to Reach the $1,000 Savings Target?

To boost your income and reach the $1,000 savings goal, consider exploring additional income streams such as freelancing, gig work, or even direct sales opportunities. Leveraging your existing skills and resources to earn extra cash can make a significant impact on your ability to save. Remember to approach any new income sources with caution and research to ensure they align with your financial goals.

What Savings Tools and Strategies Can I Use to Accelerate My Savings?

There are several savings tools and strategies you can use to help accelerate your $1,000 savings goal. These include using a cash-only budget for discretionary spending, taking advantage of round-up apps that automatically transfer small amounts to your savings, utilizing cashback programs and rewards, and taking advantage of couponing and deal-finding websites. By combining these tactics, you can maximize your savings and reach your target more quickly.