Are you tired of feeling like your money disappears into thin air? Do you wish you had a better grasp of your finances? If so, you’re not alone. Many people struggle with managing their money, but there’s a simple solution that can make a world of difference: expense tracking.

Expense tracking is the process of recording all your income and expenses, allowing you to see exactly where your money goes. It’s the foundation of effective budgeting and a crucial step toward achieving your financial goals.

This beginner’s blog article guide will walk you through the essentials of expense tracking, providing you with the knowledge and tools to take control of your finances.

By tracking your expenses, you’ll:

- Gain a clear understanding of your spending habits

- Identify areas where you can cut back and save

- Make more informed financial decisions

- Reduce financial stress and anxiety

- Achieve your financial goals faster

Whether you’re just starting or looking to improve your money management skills, this guide is for you. We’ll cover different tracking methods, expense categorization, and strategies for making adjustments.

Key Takeaways:

- Expense tracking is the foundation of effective budgeting and a crucial step toward achieving financial goals.

- There are various expense tracking methods, both traditional (pen and paper, envelope system) and digital (spreadsheets, apps), each with its own pros and cons.

- Categorizing expenses is essential for understanding spending patterns and identifying areas for improvement.

- Regularly reviewing expenses, setting realistic goals, and making adjustments are key to taking control of your finances.

- Combining multiple expense tracking methods and staying consistent with categorization can lead to better financial management.

Understanding the Basics

Before we dive into the specifics of expense tracking, let’s define some essential terms:

| Term | Definition |

|---|---|

| Budget | A plan that outlines your expected income and expenses for a specific period, helping you allocate your money wisely. |

| Expenses | The money you spend on goods and services, such as rent, groceries, transportation, and entertainment. |

| Income | The money you earn from various sources, such as your salary, investments, or side hustles. |

Why Track Expenses?

Tracking expenses is vital because it helps you understand where your money is going and identify areas where you might be overspending. Without tracking, it’s easy to fall into bad spending habits and lose control of your finances.

1. Methods of Expense Tracking

There are various methods you can use to track your expenses, each with its pros and cons.

A. Traditional Methods

Pen and Paper

This classic method involves keeping a physical notebook or notepad to jot down your daily expenses.

Pros:

- Simple and accessible

- No technology required

Cons:

- Can be tedious and prone to errors

- Not easy to analyze

Envelope System

With this method, you allocate specific amounts of cash to different spending categories and store them in labeled envelopes.

Pros:

- Visual and tangible

- Helps curb impulse spending

Cons:

- Not suitable for large expenses

- Risk of losing cash

B. Digital Methods

Spreadsheets

Spreadsheets, such as Excel or Google Sheets, offer a more organized and automated way to track expenses.

Pros:

- Customizable

- Formulas for calculations

- Create visual charts

Cons:

- Requires basic spreadsheet knowledge

- Manual data entry

Expense Tracking Apps

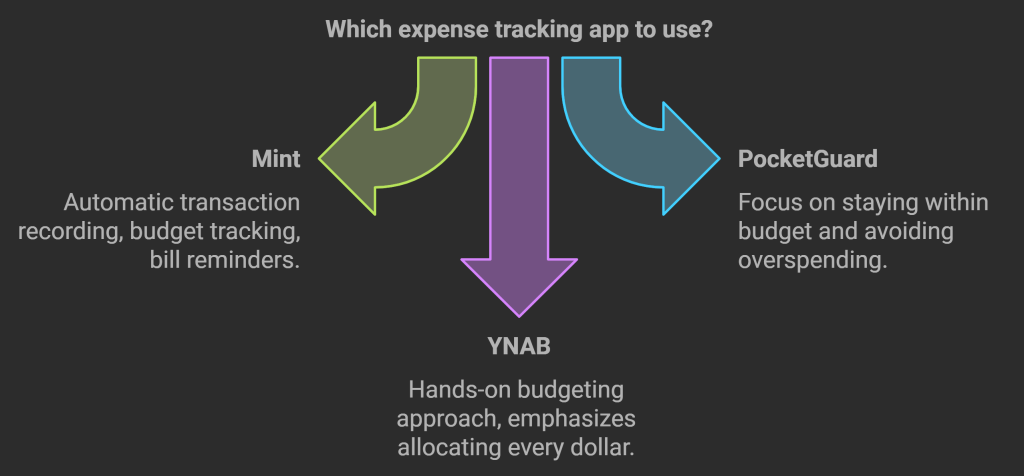

Numerous user-friendly mobile apps simplify expense tracking. Some popular options include:

- Mint: Connects to bank accounts and credit cards for automatic transaction recording, budget tracking, and bill reminders.

- PocketGuard: Similar to Mint, with a focus on helping you stay within your budget and avoid overspending.

- YNAB (You Need a Budget): Offers a more hands-on budgeting approach, emphasizing allocating every dollar of your income.

Pros:

- Convenient

- Automatic transaction recording

- Budget tracking features

- Spending alerts

Cons:

- Requires sharing financial information with third-party apps

Receipt Scanning Apps

These apps allow you to scan your receipts and extract relevant data, reducing the need for manual entry.

Pros:

- Saves time

- Reduces errors

- Stores digital copies of receipts

Cons:

- Accuracy may vary depending on the app and receipt quality

C. Choosing the Right Method

The best expense tracking method for you will depend on your personal preferences and lifestyle. Consider your tech-savvy, organizational skills, and budget. Don’t be afraid to use a combination of methods. For example, you could use an app for daily tracking and a spreadsheet for monthly analysis.

Effective Expense Categorization

Categorizing your expenses is crucial for understanding your spending patterns and identifying areas for improvement.

1. Importance of Categorization

Categorization helps you see where your money is going and makes it easier to spot trends. By breaking down your spending into categories, you can make informed decisions about where to cut back.

2. Common Expense Categories

Here are some common expense categories you can use:

- Housing: Rent/mortgage payments, utilities, property taxes, home repairs

- Transportation: Gas, car payments, insurance, public transportation

- Food: Groceries, dining out, snacks

- Entertainment: Movies, concerts, sporting events, hobbies

- Health: Medical bills, insurance premiums, gym memberships

- Personal: Clothing, beauty products, other personal expenses

- Debt: Credit card payments, student loans, other outstanding debt

- Savings: Contributions to emergency funds, retirement accounts, and other savings goals

You can customize these categories to fit your specific spending habits. For example, you might break down “Food” into “Groceries” and “Dining Out.”

3. Tips for Accurate Categorization

- Consistent Labeling: Use clear and consistent names for your categories to avoid confusion.

- Regular Review: Review your categories periodically and make adjustments as needed.

- Utilize App Features: Expense-tracking apps often offer automatic categorization, which can save you time and effort.

Analyzing Expenses and Making Adjustments

Once you’ve been tracking your expenses for a while, it’s time to analyze your spending patterns and make adjustments to improve your financial health.

1. Regular Review

- Review your tracked expenses regularly, preferably weekly or monthly.

- This will help you stay on top of your spending and make timely adjustments.

2. Identifying Spending Patterns

- Look for trends in your spending. Are there any categories where you consistently overspend?

- Are there any recurring expenses that you could reduce or eliminate?

3. Setting Realistic Goals

- Set attainable goals for reducing expenses in specific categories.

- Start with small, manageable changes rather than drastic cuts.

4. Making Adjustments

5. Tracking Progress

- Monitor your progress and celebrate small wins to stay motivated.

- Use visual aids like charts or graphs to track your progress over time.

Conclusion

Expense tracking is an essential skill for anyone who wants to take control of their finances. By understanding your spending habits, you can make informed decisions about your money and achieve your financial goals. Remember to be consistent with your tracking, use clear and consistent categories, and review your expenses regularly.

Start tracking your expenses today and begin your journey toward financial wellness.

FAQs

1. What’s the Purpose of Expense Tracking?

Expense tracking helps you understand your spending habits and identify areas for improvement. It’s the foundation for effective budgeting and achieving financial goals.

2. What are the Expense Tracking Methods?

Both traditional (pen and paper, envelope system) and digital (spreadsheets, apps) methods are available, each with its pros and cons. Choose the approach that best fits your preferences and lifestyle.

3. Why is Expense Categorization Important?

Categorizing expenses allows you to spot spending patterns and make informed decisions about where to allocate your money more efficiently.

4. How to Adjust Spending Based on Expense Tracking?

Regularly review your expenses, set realistic goals, and implement a plan to cut back on unnecessary spending. Monitor your progress and celebrate small wins.